Updated October 9, 2023

What is Financial Modeling in Excel?

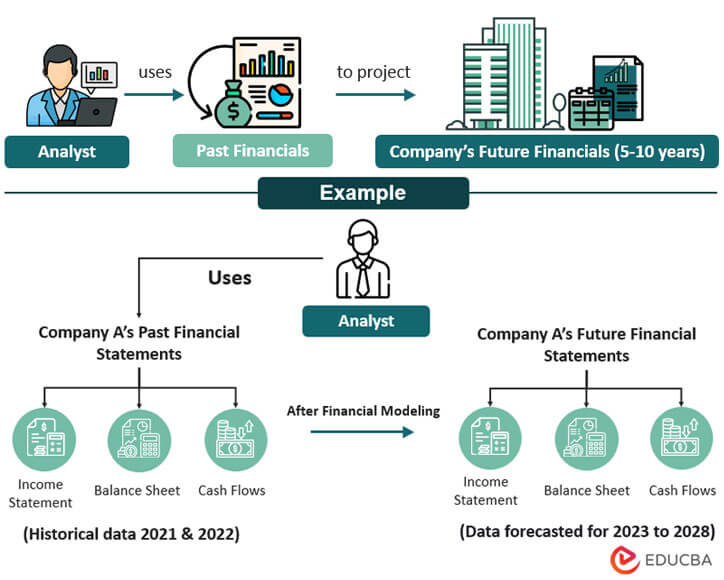

Financial modeling in Excel is a technique that involves projecting all the numbers of a company’s income statement, balance sheet, and cash flow statement for the next 5 to 10 years, using well-researched assumptions and Excel formulas.

These projections can help stakeholders like investors, analysts, and management make informed investment decisions, mergers and acquisitions, and fundraising. It’s a pretty important tool in the business world. But creating an accurate financial model in Excel isn’t easy. It requires a solid understanding of accounting principles, financial statements, and the company’s industry and market conditions. You will also need reliable data sources and assumptions based on sound analysis and research.

Check out this free guide to learn how to create a financial model in Excel. It’ll walk you through creating a fully integrated financial model using Apple as an example for 2017-2021.

Image: EDUCBA’s Financial Modeling in Excel Training

How to Create a Financial Model in Excel?

When creating a financial model in Excel, paying close attention to details is essential. You must also know your way around Excel functions and tools. You cannot just build a financial model once and be over with it. As a result, you must keep tweaking and updating your financial model to ensure accuracy and reliability.

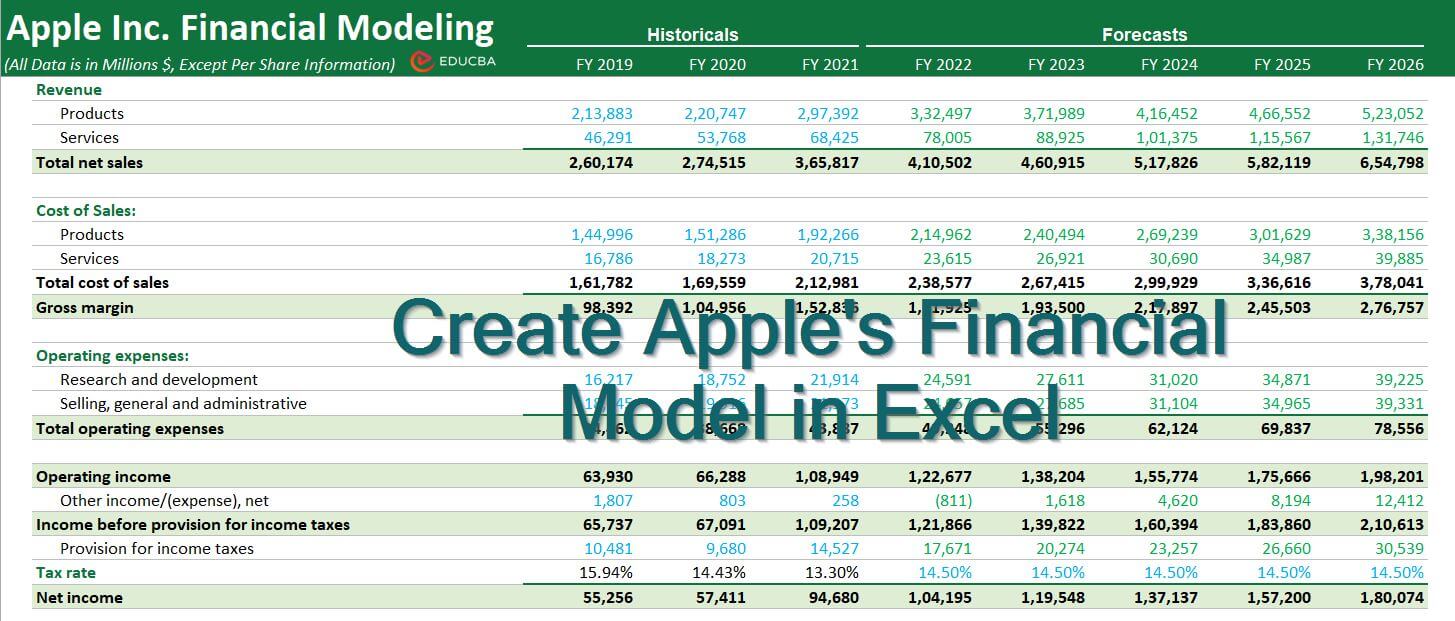

To help you get started, we have developed a free financial model of Apple Inc. that you can download.

Two versions are available: one with a solution already included and one without one so you can practice independently.

Template 1 & 2: With Solution Template + Without Solution Template (Free)

And do not worry if you’re new to financial modeling in Excel. Simply download the templates and follow our detailed step-by-step guide.

Now, let’s talk about financial modeling before we start creating one. It might seem daunting, but we will break it down for you so it’s easier to understand.

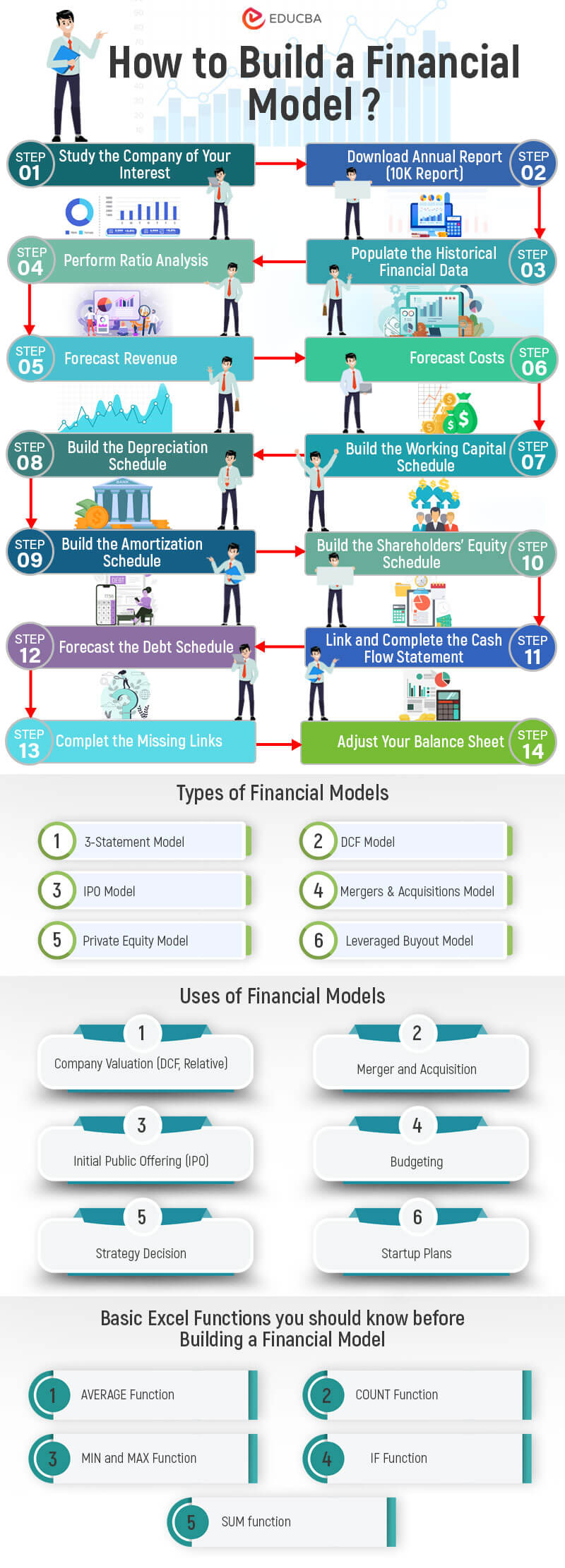

What is a Financial Model used for?

A financial model is a versatile tool used across different areas of finance, such as Equity Research, Investment Banking, and Credit Research. We can create it for various scenarios, including:

- Company valuation (using DCF valuation and Relative valuation)

- IPO evaluation

- M&A analysis (using an M&A Model)

- Project evaluation (also known as project finance modeling)

- Budgeting

- Startup planning

- Strategic decision-making and expansion.

Types of Financial Models

3-Statement Model

The 3-Statement Model involves projecting a company’s income statement, balance sheet, and cash flow statement to understand its financial performance.

DCF Model

The DCF Model looks at a company’s or investment opportunity’s value by estimating how much money it will make and then figuring out how much it is worth today.

IPO Model

The IPO Model helps determine the price at which a company will sell its shares when it first goes public on a stock exchange.

Mergers & Acquisitions Model

The Mergers & Acquisitions Model helps understand the financial impact of combining two companies and how much the new company is worth.

Private Equity Model

Private Equity firms use the Private Equity Model to decide if they should invest in a company and how to make that investment successful.

Leveraged Buyout Model

The Leveraged Buyout Model helps determine how much money investors can make if they borrow money to buy a company and then sell it later at a higher price.

The Sum of Parts Model

The Sum of Parts Model involves looking at different parts of a company and figuring out how much each is worth separately. Then, you add all the values to see how much the entire company is worth.

Options Pricing Model

The Options Pricing Model helps people determine how much money they can make by buying and selling options contracts.

Who Builds Financial Models?

Financial models are usually built by finance professionals specializing in different areas of finance, like investment banking, equity research, credit research, risk analysis, and portfolio management.

- Investment bankers and financial analysts use financial models to evaluate potential investments and determine the best course of action.

- Equity research analysts use financial models to evaluate the financial performance of companies and their stocks.

- Credit research analysts use financial models to assess companies’ creditworthiness and ability to repay debt.

- Risk analysts use financial models to assess the risk of investments and financial decisions.

- Investors and portfolio managers use financial models to decide which investments to include.

- Other finance professionals, such as CFOs (Chief Financial Officers), accountants, and financial consultants, also create financial models to support decision-making and planning.

How to Learn Financial Modeling in Excel?

If you want to learn financial modeling in Excel, you can enroll in any comprehensive course like “Financial Modeling Course (Beginner to Pro in Excel).” This course teaches you step-by-step how to do financial modeling in Excel for big companies like Apple, Twitter, Starbucks, JP Morgan, and Harley Davidson. The course covers a lot of areas, like

- Basic to advanced Excel

- Accounting

- Fundamental analysis

- Ratio analysis

- Financial statement forecasting using Excel

- Preparation of supporting schedules – depreciation, debt, working capital, etc.

- Linkages to financial statements – income statement, balance sheet, cash flows

- Discounted cash flow valuation

- Relative valuation

- Competitor analysis

- Sensitivity analysis

How to Create a Financial Model in Excel – Step-by-Step Guide

Here is the list of steps that we will follow. Please keep the “With Solution” template open while reading these steps.

- Study the Company of Your Interest

- Download the Annual Report (10K Report)

- Populate the Historical Financial Data

- Perform Ratio Analysis

- Forecast Revenue

- Forecast Costs

- Build the Working Capital Schedule

- Build the Depreciation Schedule

- Build the Amortization Schedule

- Build the Shareholders’ Equity Schedule

- Link and Complete the Cash Flow Statement

- Forecast the Debt Schedule

- Complete the Missing Links

- Balance the Balance Sheet

Here is a detailed step-by-step explanation for starting with financial modeling in Excel.

Step 1: Study the Company of Your Interest

While building a financial model, the first step is to study the company you are interested in. It means researching to get a good understanding of its financial status.

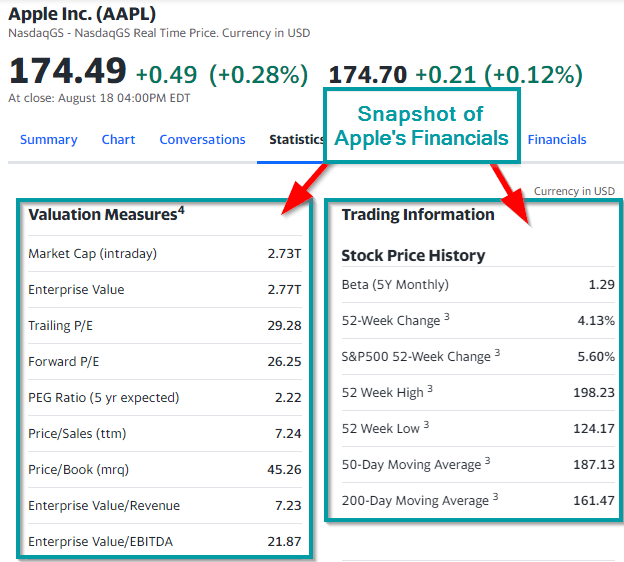

To start, you can gather basic financial information about the company. It will help you understand its performance before entering its annual reports. However, ensure you get your information from a reliable source, like Yahoo Finance or Reuters.

For example, let’s say you want to learn about Apple Inc. You can use Yahoo Finance to get a quick financial snapshot of the company. It’s a great way to get a sense of its financial health. The image below depicts the same.

Image Source: Yahoo Finance

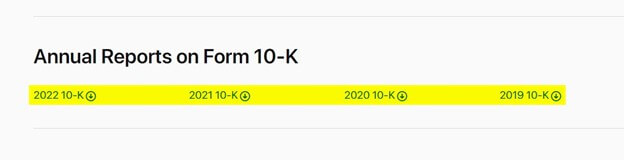

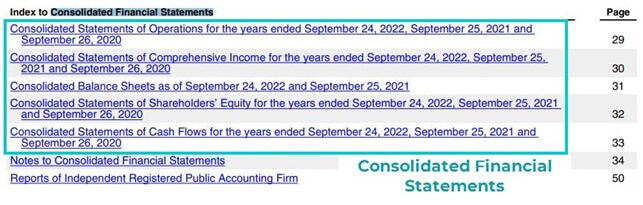

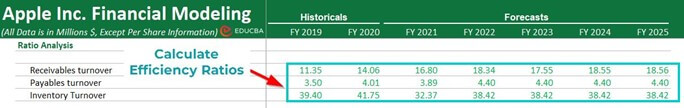

Step 2: Download Apple’s Annual Report (10K Report)

The next step is to download the company’s annual report from its official website and populate the data in an Excel worksheet.

Here’s how you can do it easily:

- First, go to the company’s official website.

- Look for the “Investor Relations” section, which you can find in the header or footer of the website.

- After that, find the section where annual reports are present and download the most recent ones. In this case, it’s the 2022 10-K

- Once you have downloaded it, open the report and search for “Consolidated Financial Statements” (shortcut: Ctrl + F). You will find an index or a section with that name, which you can use to view the company’s consolidated financial statements.

Given below is Apple’s Consolidated Income Statement (Source: Apple Annual Report 2022)

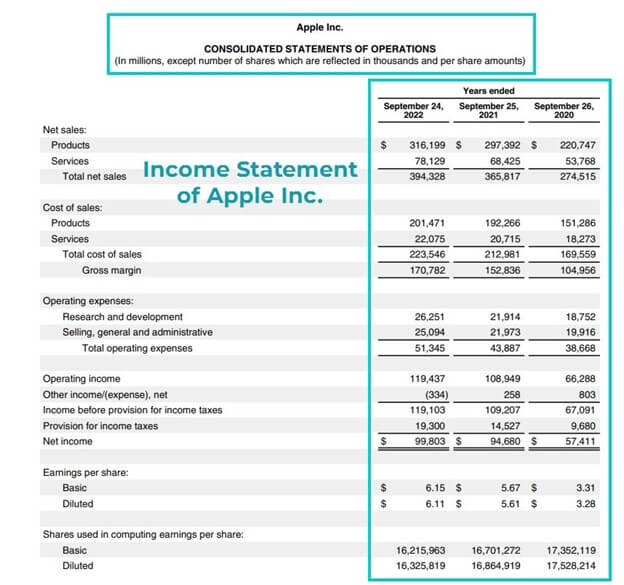

Step 3: Populate the Historical Financial Data

Here’s what we need to do next:

- We will input all the essential financial data from Apple’s 10K report (from Statement of Profit and loss, Balance Sheet, and Cash Flow Statement) into an Excel spreadsheet.

- If you look at Apple’s 10K report for the year 2022, you will see that it provides financial data for 2020, 2021, and 2022.

- But we recommend getting data for the last five years to understand how the company is doing. It will help us make better projections about where the company is heading.

- So, download Apple’s annual reports from the past 2-3 years and fill in the Excel spreadsheet with all the historical financial data.

We have already done this for you. We have populated three years of historical data of Apple Inc. in the Income Statement tab, Balance Sheet tab, and Cash Flow Statement tab of an Excel sheet (Without Solution Template).

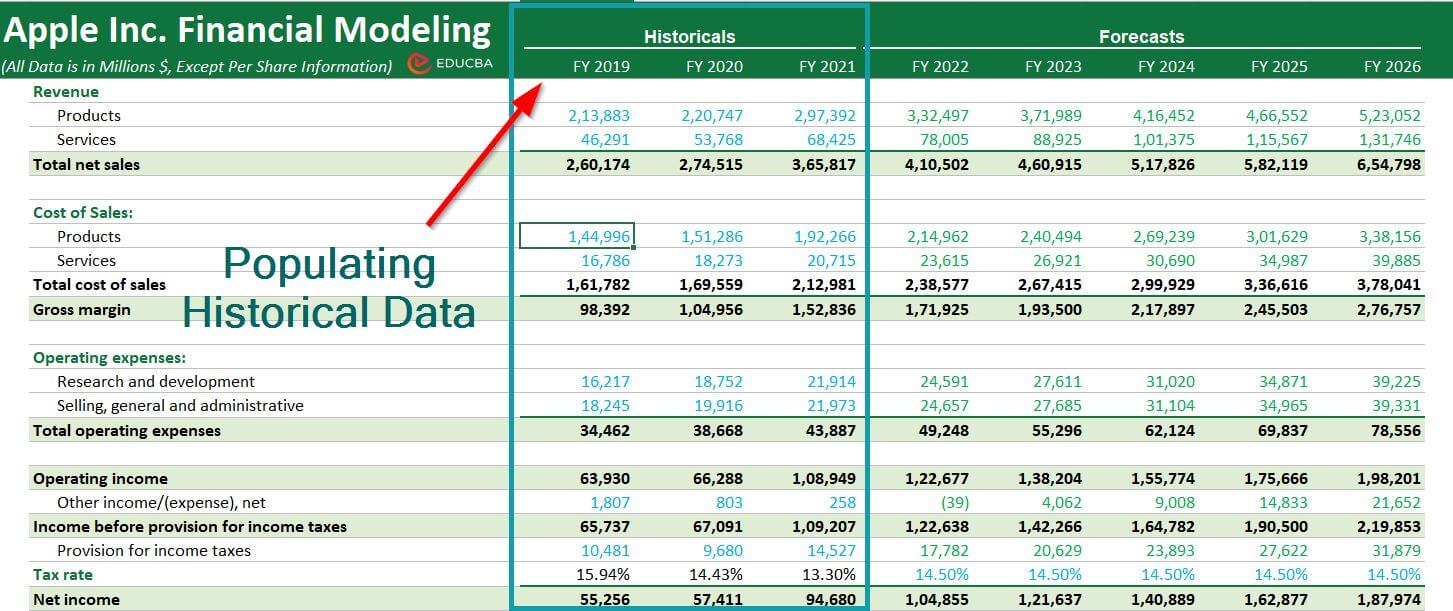

Step 4: Perform Ratio Analysis

Before we start with the forecasting process, we will conduct a thorough ratio analysis. In ratio analysis, we will compare historical numbers related to Apple’s business by dividing one number by another. It will help us understand if the company is performing well and use the results to make decisions.

Also, we have a detailed article called “Ratio Analysis Types” that talks about 24 different kinds of ratios and even gives you free Excel templates to practice with! Thus, if you want to know more about each type of ratio that we will use for financial modeling in Excel, please check out that article.

So, let’s start by analyzing some crucial ratios of Apple Inc.

Horizontal and Vertical Ratio Analysis:

Horizontal ratio analysis is when we compare the financial data of a company over multiple financial years to understand its trends and changes in performance. It helps us know how the company is performing over time.

Vertical ratio analysis compares the different line items on a company’s financial statement for one accounting period. For example, if we divide the current assets and current liabilities of Apple Inc. for the year 2022, it is a vertical ratio analysis. We use this to identify their relationship, importance, resource allocation, etc.

We will be using vertical ratio analysis to create Apple’s financial model.

Calculate the Liquidity Ratios of Apple:

Liquidity ratios show if a company has enough money to pay what it owes (debts and liabilities) in the short term (less than 12 months). A higher liquidity ratio means that the company has more than enough financial reserves and can easily cover what it owes.

Here are the most common liquidity ratios:

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = (Cash and Cash Equivalents + Marketable Securities + Accounts Receivables) / Current Liabilities

- Cash Ratio = Cash & Cash Equivalents / Current Liabilities

Calculate the Efficiency Ratios of Apple:

We calculate efficiency ratios to determine how effectively a business uses its available resources or turns its inventories into cash. We can also call them turnover ratios.

The most common efficiency ratios are:

- Receivables Turnover Ratio = Sales / Accounts Receivable

- Inventory Turnover Ratio = COGS / Average Inventories

- Payable Turnover Ratio = COGS / Accounts Payable

- Asset Turnover Ratio = Sales / Total Assets

- Net Fixed Asset Turnover Ratio = Sales / Net Fixed Assets

- Equity Turnover Ratio = Sales / Total Equity

Calculate the Operating Profitability Ratios of Apple:

Profitability ratios will help us evaluate the company’s ability to make money and generate adequate profits.

The most common operating profitability ratios are:

- Gross Margin = (Sales – COGS) / Sales

- Operating Profit Margin = EBIT / Sales

- Net Margin = Net Income / Sales

- Return on Total Asset (ROA) = EBIT / Total Assets

- Return on Total Equity (ROE) = Net Income / Total Equity

Calculate the Financial Risk Ratios of Apple:

We use financial risk ratios to see if a business can meet its long-term obligations. For this, we compare the company’s level of debt to its assets or equity.

The most common financial risk ratios are:

- Debt-To-Equity Ratio = Total Debt / Total Equity

- Debt Ratio = Total Debt / Total Assets

- Interest Coverage Ratio = EBITDA / Interest Expense

Step 5: Forecast Revenue

When performing financial modeling in Excel, the most important thing to consider is how much money (revenue) the company will make in the future. As a financial analyst, spending extra time figuring out the best way to predict this is important.

Also, when choosing a method to predict revenue, you need to consider what type of company it is, what sector it’s in, and what information you have about it.

Here are some standard methods that analysts use to predict revenue:

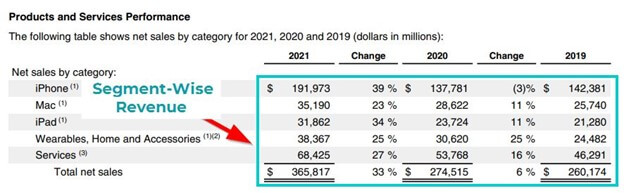

A) Segment-wise Revenue

This method works well for companies with many different products or businesses. In this case, we first figure out how much each part of the company will make, then add it to get the total revenue.

For forecasting Apple’s revenue, we will be using this method. Here’s how:

In Apple’s 10K report or annual report, we will look at all the different things it sells (like iPhones, Macs,iPads, Wearables, Home and Accessories, and Services) and determine how much revenue each will generate. Then, we will add all the individual revenues to get the total revenue.

Following are the revenue segments of Apple as given in its Annual Report.

(Source: Apple Annual Report 2021, Page no 21)

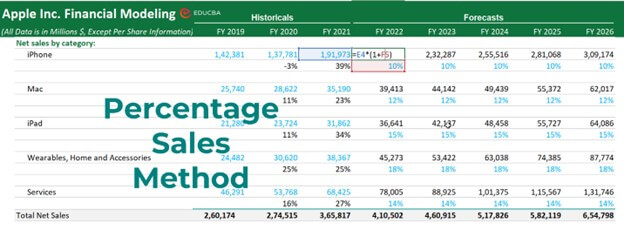

The steps for Calculating Apple’s Revenue are as follows:

- We will first determine year-over-year growth for each product segment (e.g., iPhones, Macs, iPads, Wearables, home, and Accessories)

- To do this, we will use the percentage of sales method to project revenue for each segment.

- Then, we will add up individual segment revenues to get the total revenue forecast.

Check out the image below to see the revenue forecast for Apple from FY 2023 to FY 2026.

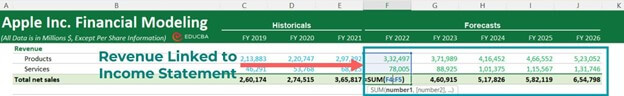

Link the Revenue to the Income Statement

B) Geography-wise Revenue

Although we will not use this method to forecast Apple’s revenue, it’s still important to understand it. You can use this method for other companies where it does work.

When we talk about “geography-wise revenue,” we are talking about the total amount of money a company makes in different locations. For example, companies with offices in different countries might make more money in some countries than others. It is something that multinational companies like Microsoft, Coca-Cola, Procter & Gamble, and Nestle can use to analyze their revenue streams.

C) Revenue by Store Count

If a company plans to expand its stores, it can use a “Revenue by Store Count” method to forecast revenue.

As a financial analyst, you must know a few calculations using this method.

- Firstly, you must determine the ending store count (final number of stores) at the end of the accounting period. For this, you will need to add the number of new stores to the beginning store count and then subtract the number of stores that have been closed.

- Once you know the ending store count, you can calculate the period’s total revenue. To do this, you must multiply the number of open stores and the average sales per store during that time.

So, the formula is:

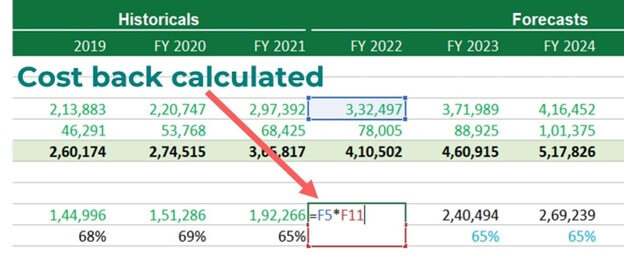

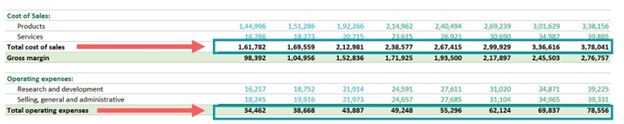

Step 6: Forecast Costs

Forecasting costs means estimating how much money a company will spend in the future. One popular method for forecasting costs is called the vertical analysis approach.

To use this approach, you take each cost (like the cost of producing “Product XYZ”) and divide it by the net sales for that year. It gives you the cost margin percentage, which shows how much each sale covers that cost.

Then, you look at historical cost margins to develop an estimated future-year margin. It helps you predict how much that cost will be depending on how much the company expects to make from sales.

To illustrate this method, let us examine Apple’s product cost, which was 69% of net sales in 2020 and 65% in 2021. Based on this trend, you could assume the price will be 65% of net sales for all projected years (FY 2022 to FY 2025).

We will use this margin to determine our products’ actual costs. We multiply the projected sales for a year ($3,32,497 Million) by 65% to get the product cost for that year ($2,14,962 Million).

But that’s not all the costs. There are other expenses we need to consider too. So, we calculate the remaining costs and add them to the product cost to get the total cost for the year.

Finally, we will link these costs to our income statement to see how our company is doing financially.

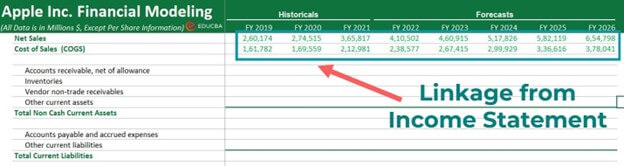

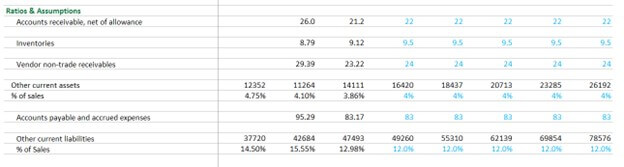

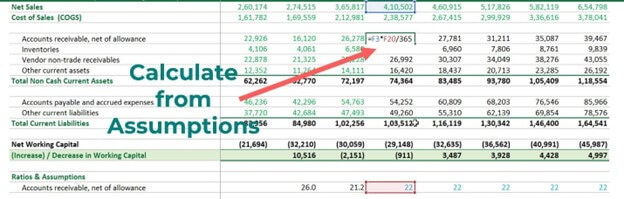

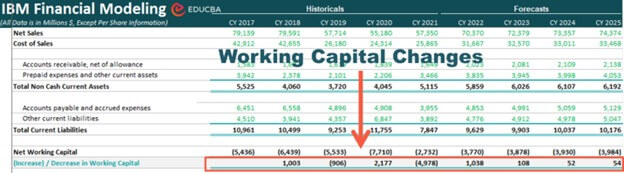

Step 7: Building the Working Capital Schedule

Follow these steps for the working capital schedule calculations:

- First, we must link the Net Sales and COGS from the Income statement to the working capital schedule.

- Next, we will link the historical balance sheet data to the working capital.

- Now, we will calculate the historical ratios and make assumptions for future years.

- Once we have our assumptions, we will calculate the future working capital items based on those assumptions.

- Next, calculate the Increase or (Decrease) in the working capital compared to the previous year.

- Finally, carefully link the projected values to the Balance Sheet and Cash flows. (Make sure you are not making double entries. You can download the free model to check the links.)

Note:

We have assumed that the values for the following items will remain the same as FY 2021 for the projected years:

- Marketable securities

- Deferred revenue

- Commercial paper

- Term debt

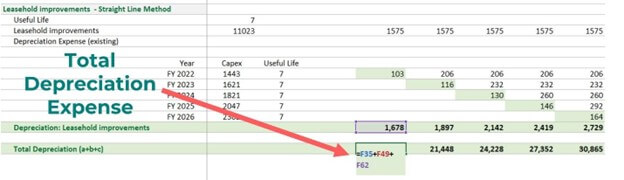

Step 8: Build the Depreciation Schedule

We will start with the projections for Apple’s Depreciation over the next five years. Apple’s historical depreciation values are found in its consolidated cash flow statement.

To create a complete depreciation schedule, we will need to calculate a few different values, such as:

- Capex

- Ending Net PPE

- The breakup of Current PPE

- Forecasted Breakup of PPE

- Depreciation of Individual Assets

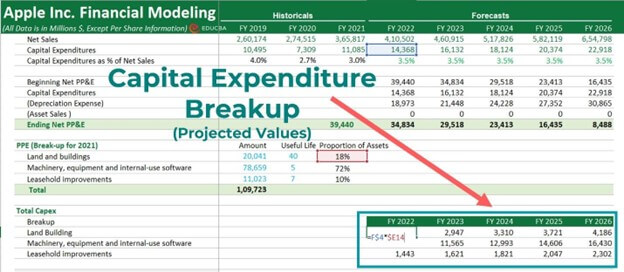

A. Steps to Calculate Capex:

- First, we will link the net sales from the income statement.

- Now, fill in the numbers for the historical Capex.

- After that, you need to calculate Capex as a percentage of net sales for the previous years ((CapEx / Net Sales) x 100)

- Next, input the estimated Capex figures for future years in the annual report, management discussions, or press releases into an Excel template.

- Otherwise, if no such data is available, we can forecast future Capex based on historical data. For this, we will be assuming a percentage based on previous years. As seen in the image below, we choose 3.5% as the percentage.

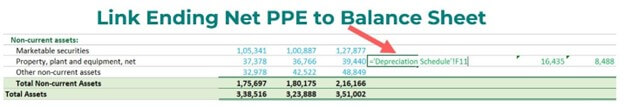

B. Steps to Calculate Ending Net PPE:

- First, we will link the Net PPE values for the historical years from the balance sheet.

- Now, input the Capex values from the previous calculations.

- Note the BASE equation to calculate the Ending Net PPE is:

- You will notice that in the above equation, we can’t link the depreciation values for future years because we haven’t calculated them yet. So, let’s leave them blank for the time being. We can link them once we have done all of the calculations.

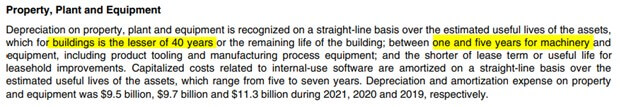

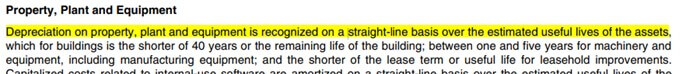

Depreciation Policy and Useful Life of Assets

Companies generally disclose their depreciation policies and the valuable lives of their assets in their annual reports. You may have to make logical assumptions if this information is not explicitly given.

For Apple, the depreciation policy and useful lives of individual assets are present in their Annual Report 2021, specifically on page 35.

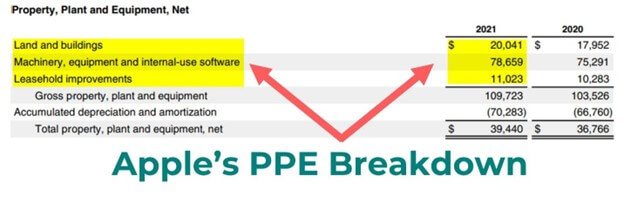

In the annual report, you will also find details of Apple’s Property, Plant, and Equipment details for FY 2021 (Apple Annual Report 2021, Page no 40):

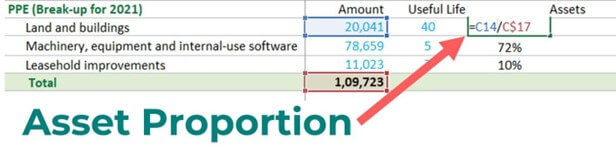

C. Calculate the Proportion of Assets for current PPE (2021)

To find the proportion of each asset, we can use the formula: Gross PPE of each asset/Total Gross PPE.

D. Forecast Breakup of Property, Plant & Equipment (PPE)

Once we have estimated CAPEX and the asset proportions, we can calculate the future PPE breakup as follows:

E. Calculate Depreciation of Individual Assets

To calculate the depreciation of individual assets for Apple, we need to consider three different types of assets, as mentioned in its annual report:

- Land and buildings

- Machinery, equipment, and internal-use software

- Leasehold improvements

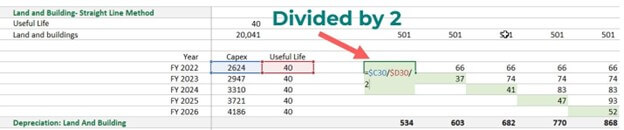

Depreciation Calculation: Land and Building

We will use the straight-line method stated in their annual report to calculate the depreciation of Apple’s land and buildings.

Here’s how to do it:

- First, we will transpose the Capex values of Land and buildings using the Transpose function in Excel.

- Then, we will calculate the depreciation in two parts:

- We will calculate the depreciation for the land and buildings that are already present on the balance sheet.

- Next, we will calculate the depreciation for future investments in land and buildings. In this case, we will divide the first year’s depreciation value by 2, assuming the asset was bought mid-year.

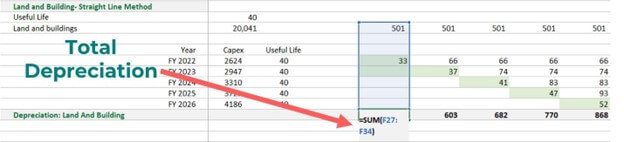

- To arrive at the total depreciation for land and building, we will add the following:

Depreciation of the listed assets on the balance sheet + Newly acquired asset’s depreciation.

- Similarly, we will calculate the depreciation for all other assets and add them to the total depreciation.

- Once we have the total depreciation, we will link the numbers to the table where we are supposed to find the Ending Net PPE. By linking the depreciation, you can find the Ending Net PPE for each forecasted year, as seen in the image below.

After finding the Ending Net PPE, we will link it to the balance sheet.

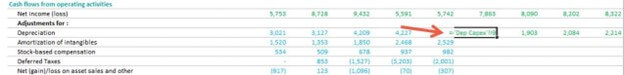

Similarly, we will link the Depreciation to the Cash Flow Statement.

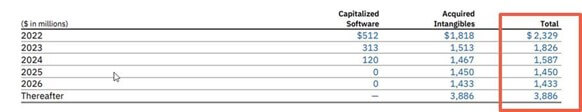

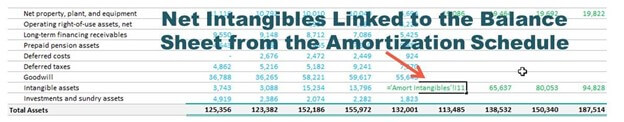

Step 9: Build the Amortization Schedule

To build the amortization schedule, you must first calculate the Addition to Intangibles. We will use IBM’s amortization schedule as an example since Apple does not require a separate amortization schedule. It will help you understand the steps involved more easily.

Steps to Calculate Addition to Intangibles:

- Link the net sales from the income statement and fill in the figures for historical intangibles.

- Determine Addition to Intangibles as a percentage of net sales for the previous years.

- If the company has provided estimated Additions to Intangibles for future years in their annual reports, that’s great! You can use those values.

- But if not, don’t worry; you can forecast Addition to Intangibles based on historical data, as seen in the image below.

Here’s how you can Forecast the Amortization of Individual Intangibles

Let’s talk about forecasting the amortization of individual intangibles. It’s similar to the process we used to forecast individual asset depreciation.

When it comes to IBM, their intangible assets include:

- Capitalized software

- Client relationships

- Completed technology

- Patents/Trademarks

- Other** (includes acquired proprietary and nonproprietary business processes, methodologies, and systems)

Luckily, IBM has given us the forecasted amortization values in their Annual report.

We can simply link these values in the financial model and calculate the Ending Net Intangibles.

The next step is to link the Ending Net Intangibles to the balance sheet.

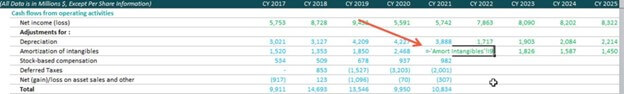

We will also link amortization to the cash flow statement. It’s all about connecting the dots and ensuring we account for everything.

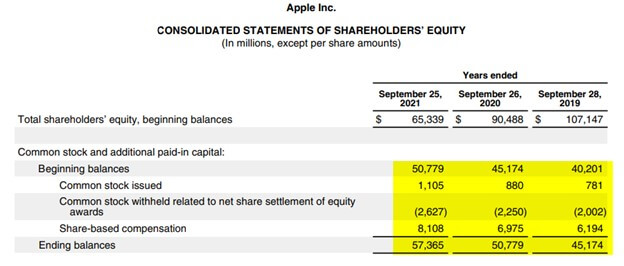

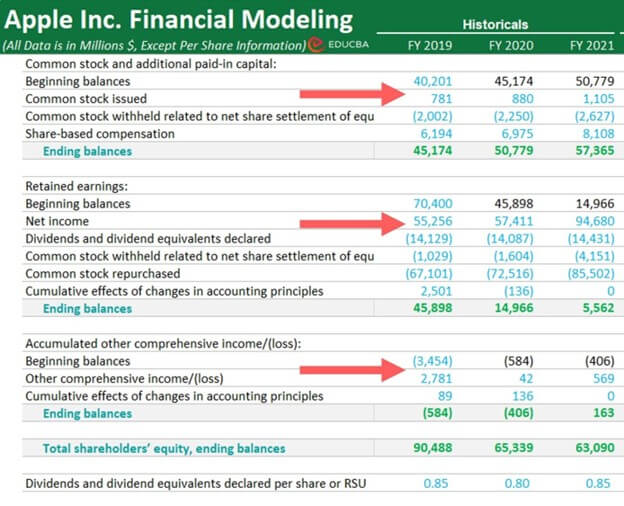

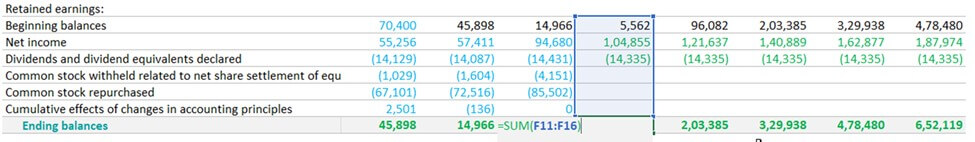

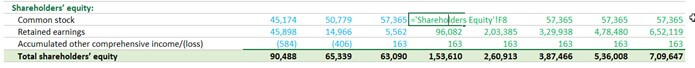

Step 10: Build the Shareholders’ Equity Schedule

The next step in financial modeling in Excel for Apple is to prepare the shareholder’s equity schedule in Excel. In this schedule, we aim to forecast all the equity-related items such as shareholder’s equity, dividends, etc.

We will start by Linking Historical Numbers to the Shareholder’s Equity Schedule.

- From its Consolidated Statements of Shareholders ‘ Equity, we can obtain details of beginning balances, common stock, retained earnings, and other comprehensive income/(loss) for Apple (Page no 32).

- Populate these historical numbers in the shareholder’s equity schedule tab.

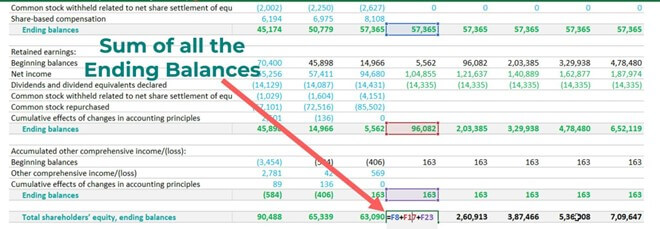

Determine Ending Balance for Common Stock:

Next, determine the Ending Balance for Retained Earnings:

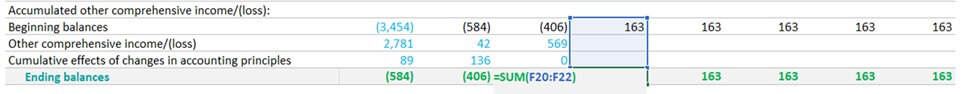

Determine Ending Balance for Accumulated other comprehensive income/(loss):

Now, finally, we will add all the Ending Balances

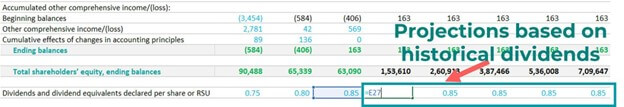

Forecast Dividends

To forecast dividends, we must first find the historical dividend payout ratio using this formula: Dividends Paid/Net Income. Using these historical payout ratio numbers, we will then assume a payout ratio to forecast dividends for future years.

1. Apple has provided us with the dividend payout ratio as “Dividends and dividend equivalents declared per share or RSU” in the annual report under “CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY” for the historicals.

2. we will directly populate those numbers in our Excel model.

3. Now, let us make assumptions based on the historical numbers. Simply link cell E27 to cell F27, hit Enter, and drag it for all future years. We assume that dividends per share will remain constant as of FY2021.

Link Ending Balances from Shareholder’s Equity Schedule to the Balance Sheet

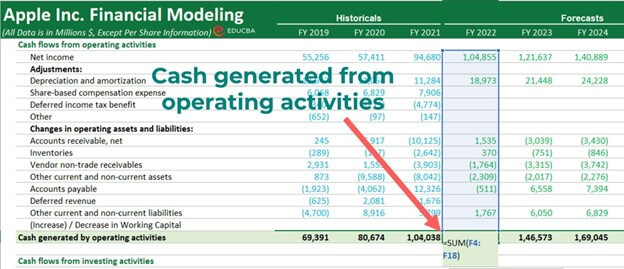

Step 11: Link and Complete the Cash Flow Statement

Now, let us link the respective cash flows from operating activities to calculate the cash generated by operating activities.

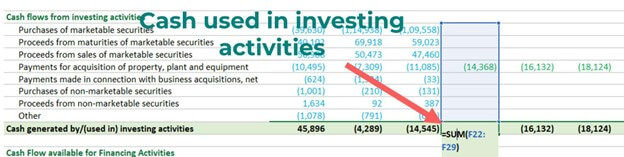

Link the cash used in investing activities and calculate the total amount below.

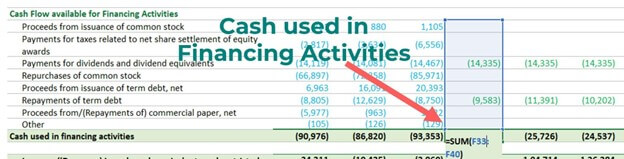

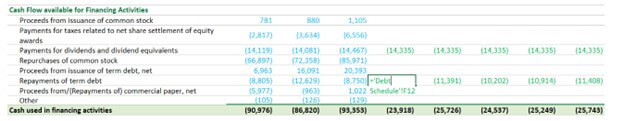

Then, calculate cash used in financing activities, as seen below.

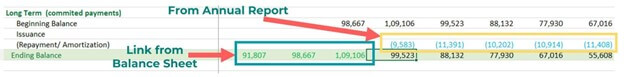

Step 12: Forecast the Debt Schedule

Calculating Cash Available for Debt Repayment

Calculating a company’s cash available for debt repayment can be tricky, but don’t worry. We’ll guide you through it step by step.

- Start by linking values from the cash flow available for financing activities and the beginning cash balance.

- Then, assume a minimum cash balance the company needs to keep as a reserve. It will depend on the company’s beginning cash balance and can vary from company to company. For our example, let’s assume a minimum cash balance of $20,000 for all forecasted years.

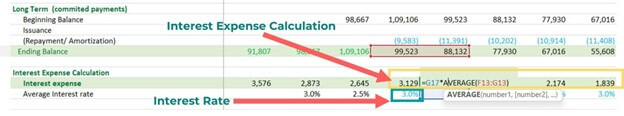

Calculating Ending Balance of Long-term Debt

- To create a long-term debt schedule, the first step is to connect the ending balance for each historical year from the balance sheet.

- Once we have the ending balance for FY 2021, we will use it as the beginning balance for FY 2022, and we will link all forecasted years accordingly.

- Then, we will look for the future payments that Apple will make as provided in their annual report and populate those numbers as “Repayments”. Not all companies give this data, so that you may need additional research.

- To determine the ending balance of the long-term debt, we will simply subtract the future payments from the beginning balance.

Link Ending Balance of Long-Term Debt to Cash Flow Statement

Interest Expense Calculation: Long-term Debt

- First, link the interest expense from the income statement for historical years (FY 2019, FY 2020, and FY 2021).

- Then, calculate the “Average interest rate” for these historical years. For example, to calculate the average interest rate for FY 2020, use this formula:

Interest expense of FY 2020 / Average(Long-term debt for FY 2019 + long-term debt of FY 2020).

- Similarly, calculate the average interest rate for FY 2021.

- Based on historical interest rates, we will assume an interest rate of 3% for the forecasted years and start calculating the interest expense for these years.

Interest Income Calculation

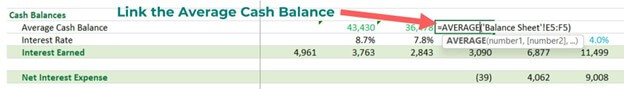

We will link the cash and cash equivalents from the balance sheet to calculate interest income by taking their average. The interest rate can be considered the average saving rate that banks provide. Then, we can calculate the interest earned for each forecasted year.

Calculate the Net Interest Expense

Link the Net interest expense to the Income Statement

Step 13: Complet the Missing Links

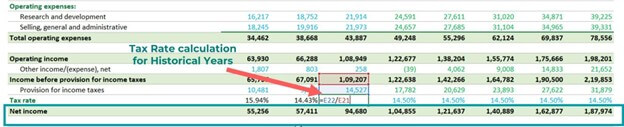

Income Tax Calculations

To calculate the “Provision for tax rate” in the Income Statement, we will calculate the tax rate for the historical years and assume a reasonable tax rate for the forecasted years.

Then, finally, we will calculate Net Income.

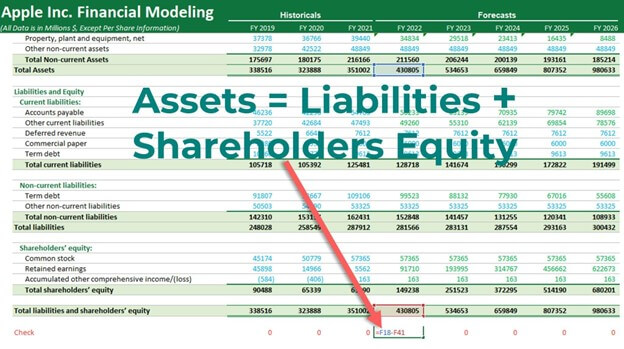

Step 14: Balance the Balance Sheet

In this step, we will complete all missing links in the balance sheet and audit it to ensure that the check is “0” everywhere. It means that:

By following this process, you will have successfully created a comprehensive financial model from scratch. We have detailed explanations for each step to help you understand the financial modeling process in Excel. Further, if you have any questions or concerns, please don’t hesitate to comment below.

Happy Learning!

Prerequisites to Create a Financial Model

To build financial modeling in Excel, you must have the following requirements:

Fundamental Knowledge: Firstly, you need to have some basic knowledge of how to read financial statements. Creating depreciation, amortization, and other schedules will be easier if you understand accounting principles. You should also be aware of common financial ratios.

Excel: You must have access to Microsoft Excel or another spreadsheet software. Even if you’re not an Excel expert, a basic understanding of the interface and formulas can be helpful. Don’t worry if you’re not confident with it, though – we can guide you with detailed screenshots to help you understand the steps.

Planning: Before building your financial model, you must plan your goals. What’s the purpose of the model? Are you building it for mergers or acquisitions, to raise money through an IPO, or to make future business decisions? You should also decide on a timeline – how long will you use the model?

How to Format a Financial Model in Excel?

For better readability and understanding of your financial model, you can format your models using the following color codes and sign conventions:

Color Coding

You can follow this color coding for your financial modeling in Excel :

| Input Type | Color | Demonstration |

| Formulas | Black | =Sum(C1:C22) |

| Hard-coded numbers | Blue | =3,425 |

| Linkages (to other sheets) | Green | =’Cost Sheet’!A22 |

Sign Convention

We recommend that you use the following sign convention for your model:

| Input Type | Sign Convention | Demonstration |

| All types of income | Positive | Revenue: 78,969 |

| All types of expenses | Negative (in brackets) | Interest Expense: (615) |

Apart from the above parameters, a financial model should be:

- Easy to understand

- Have simple formulas

- Must have comments to emphasize important data

- Must have accurate data

Excel Skills for Financial Modeling

As Excel proficiency is necessary for financial analysts, analysts should be familiar with the basic Excel functions. We have made a list of standard Excel functions below:

| Excel Function | Typical Use in Financial Modeling |

| SUM | It adds a range of numbers. Example: Adding a series of monthly revenues or expenses. |

| AVERAGE | It calculates the average of a set of numbers. Example: Computing average monthly revenue or expense. |

| COUNT | It counts the number of cells that contain numbers/data. Example: Total number of customers or units sold. |

| MIN and MAX | It finds the minimum and maximum values from a range. Example: The minimum/maximum stock price over a period |

| IF | It allows a cell to make decisions and display different results depending on whether the condition is met. Example: Calculating revolving credit facility in debt schedule. |

| VLOOKUP and HLOOKUP | It looks for a value in a table and returns a corresponding value from the same row/column. Example: Looking up the price of a product in a price list. |

| INDEX and MATCH | It looks up a value in a table based on multiple criteria. Example: Looking up the price of a product based on its name and category. |

| ROUND | It rounds the number to a specified number of decimal places. Example: Rounding interest rate or tax rate to two decimal places. |

| NPV | It calculates the net present value of an investment using a series of cash flows. Example: Determine the value of a firm’s manufacturing plant, a long-term investment. |

| IRR | It calculates an investment’s internal rate of return, which is the rate at which the net present value of cash flows equals zero. Example: To determine if a particular investment is worth pursuing. |

| Excel Chart | A chart often makes understanding the data in a worksheet easier because users can easily identify patterns and trends. |

Financial Modeling in Excel – Ratios

In the following table, we list commonly used ratios and the schedules in which they are applied.

| Ratio | Financial Modeling Schedule |

| Gross Margin | Income Statement |

| Operating Margin | Income Statement |

| Net Profit Margin | Income Statement |

| Return on Investment (ROI) | Cash Flow Statement, Balance Sheet |

| Return on Equity (ROE) | Cash Flow Statement, Balance Sheet |

| Debt-to-Equity Ratio | Balance Sheet |

| Debt-to-Asset Ratio | Balance Sheet |

| Current Ratio | Balance Sheet |

| Quick Ratio | Balance Sheet |

| Days Sales Outstanding (DSO) | Working Capital Schedule |

| Days Payable Outstanding (DPO) | Working Capital Schedule |

| Inventory Turnover | Working Capital Schedule |

| Capital Expenditure Ratio | Depreciation Schedule |

| Earnings per Share (EPS) | Income Statement |

Example of Financial Modeling In Excel – Infographics

Frequently Asked Questions (FAQs)

Q1. Is Excel good for financial modeling? What software is best for financial modeling?

Answer: Yes, Excel is a good tool for building financial models. It is versatile, easy to use, and very common among finance professionals. Thus, beginners, as well as senior analysts, can use Excel to build financial models. However, if you want to use another software, you can use Oracle BI, Jirav, Cube, and more online tools.

Q2. What are the major components of financial modeling?

Answer: The company’s financial statements are the major components we use to create Excel financial modeling. A company’s financial statements include the income statement, the balance sheet, and the cash flow statements. However, use the consolidated statements from the company’s annual report, not the standalone ones.

Q3. What is the purpose of financial modeling?

Answer: The main purpose of building these models is to create a numerical representation of a company’s financial performance. It helps businesses make informed decisions about financial planning, capital allocation, and strategic investments. Another reason for building these models is to raise funds (IPO), mergers and acquisitions, etc.

Recommended Articles

Here are some articles that will help you to get more detail about Financial Modeling In Excel, so just go through the link.