Updated October 26, 2023

Introduction to Investment Banking Career

Banking is a term associated with all of us and our daily lives. Money flow from one bank account to another is generally considered banking in layman’s terms. At this time, Everyone had a bank account. After the government’s “Jhan Dhan Yojna”, the unorganized and other categories who did not have bank accounts also applauded to open bank accounts. Now, let’s talk about a Career in Investment Banking. It is as simple as the water formula, so Investment Banking is defined as the process in which bank and other firms in the financial market lend their money to big companies to enhance their business.

Assume one person runs a company and wants to enhance its business by taking over another firm or any other mode, but he does not have as much to explore his business. Here, the role of financial investment firms came; that person can directly approach the firms, and after discussing his plan with investment firms, he takes as many loans as required. Financial firms known as investment banks do this task through their representatives known as “Investment Bankers”. Which is the reputed post in the finance sector?

Which Skills Can Be Helpful or, More Specifically, Wanted by the Industry?

Investment Banks employ candidates with a combination of strong analytical and interpersonal skills. Certain job areas are more inclined towards only particular specialized skill sets, like the brokers are expected to be good salespeople.

| Skills | Intensity |

|---|---|

| Communication abilities | High |

| Research and Analytical abilities | High |

| Sales/Negotiation | Medium to High |

| Spreadsheet and computer literacy | High |

| Creativity | High |

| Multitasking ability | High |

| Time Management and Working Hours | High |

Some of the areas in Investment Banking call for strong Mathematical abilities. So, if you are good at math, you can think about getting deeper into technicalities like stochastic calculus, indicators, etc., or even learn more about options pricing, bond valuation, etc.

Accounting also plays a very important role in analyzing numbers critically, and managing the figures is a core part of an investment banking career.

Teamwork is a very important factor for the successful establishment of the investment bank, as people from different backgrounds and personalities should stand together to pursue the client’s trust.

The biggest misbelief about Investment Bank is that it only employs people from the finance domain. Though the biggest chunk that works in any Investment Bank is from the Finance domain, people from the Science and law domain are also needed here. Scientists are the people who can work on derivatives algorithms in banking arenas. Lawyers will help design new securities, understand and apply the business laws, and many other departments of Investment Banking career.

Moreover, the most important skill set required is Hard work, which is expected and respected in the domain as this work involves high-risk, tough jobs and work under pressure.

Education Required for Making a Career in Investment Banking

Financial firms Hire educated and skillful people for this job. So, to get a Career in Investment Banking, one must be well educated Because this is related to money, which requires higher responsibility.

So, the education required to make a Career in Investment Banking is as follows:

- A person should have a graduate degree in B.COM/M.COM.

- A person with a dual degree in Bachelor of Commerce and LLB is appreciated.

- Good communication and interaction skills.

- Decent knowledge of finance is appreciated.

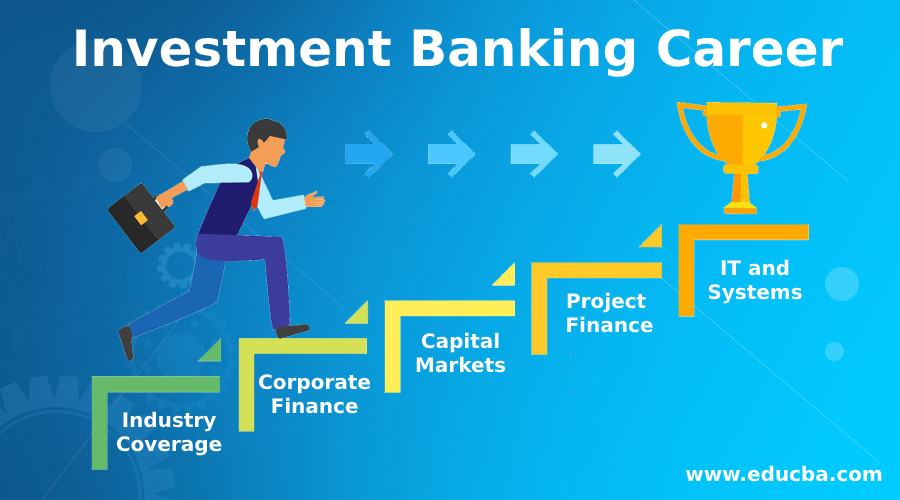

Job Options Available in Investment Banking Career

“Investment Banker” is a good career, and the rate of promotion is very high; here are the hierarchy and job positions in investment banking:

|

Experience (Years) |

Position |

|

0-2 |

Relationship Executive |

|

2-4 |

Senior Relationship Executive |

| 4-6 |

Associate Manager (Investment) |

| 6-10 |

Senior Manager (Investment) |

So, with more experience, one can reach a higher position in the organization.

Some of the options for the application areas for a Career in Investment Banking are:

- An investment banker for the Real Estate business.

- A manufacturing and other industry investment banker.

- An investment banker for the corporate sector and IT companies.

Some famous giants in the investment banking sector are as follows:

- CITI

- ING

- KIMCO

- STARWOOD

- FRISKA

- AIG

- BARCLAYS CAPITAL

- DEKA

Apart from these firms, many other market giants open handily, welcoming finance graduates.

Salaries Offered in the Investment Banking Career Path

Being an investment banker is prestigious and provides respect and a good career. Finance-related representatives are always respected in the market because where the money comes from, respect and class are already there. So, the giants and other firms that recruit investment bankers provide a decent salary and other allowances.

Some details regarding the salary in the market at different positions are as follows:

|

Position |

Salary (Per Month) |

|

Relationship Executive |

18K to 25K |

|

Senior Relationship Executive |

30K to 40K |

|

Associate Manager (Investment) |

50K to 65K |

|

Senior Manager (Investment) |

75K to 90K |

The investment bankers also get the commission from the salary when the deal is finalized. The commission may vary from deal to deal. So, the salary is not a concern in the field of the investment market.

Career Outlook in Investment Banking

The investment banking sector is growing daily due to the hike in investment in different new and old projects in the market. Many government and other reports show that opportunities will arise in investment banking in the upcoming time because of the inflow of new projects in the market due to different schemes of the government like Stand Up India, Make in India, and other entrepreneurship programs that empower the people and youth to become a job giver instead of job seeker by establishing their own business. So these things demonstrated that the scope and employment of investment banking are rising and will continue to grow.

Which are the Well-known Investment Banks?

I know this question must have a stroke in your mind.

| Goldman Sachs |

| Morgan Stanley JPMorgan Chase |

| Bank of America Merrill Lynch |

| Deutsche Bank |

| Citigroup |

| Barclays Capital |

| Credit Suisse |

| UBS |

| HSBC |

| Nomura Holdings |

| RBC Capital Markets |

| BNP Paribas |

| The Royal Bank of Scotland Group |

| TD Securities |

| Wells Fargo |

| Lazard |

| Jefferies Group |

| Société Générale |

| BMO Capital Markets |

What preparation did you need to do to crack the Investment Banking Interview?

Cracking an Investment banking interview is not a big deal if you are clear with your concepts and knowledge. You should be confident about what you are answering. After all, you have to sell yourself to get selected. Go through our article Q&A on Investment Banking topics for better practice.

Investment Banking Career Path Important Facts and Advice for Job-Seekers

-> Create and Maintain Good Contacts.

To break into an investment banking career path, the key is to set up a good network of contacts. You should attend industry conferences, informational seminars, and interviews. Also, you can contact alums from colleges who currently work in the industry.

-> The best way to enter is by finding Analyst jobs.

Attend the campus interviews. Take the offer even though the salary is not that high. To succeed in these positions, one should be extremely dedicated, hardworking, and knowledgeable.

-> Investment Banking career path is the highest global business.

Investment bankers spend plenty of time tracking corporations all around the world. Most investment banks have a global existence as well.

-> The investment banking business is highly competitive.

As we can see, the investment banking business is spread worldwide. The competition in the existing market and the emerging market are highly competitive.

-> Increasing labor arbitrage

Outsourcing is happening in a larger space in the analyst and associate roles. So here stands the opportunity for countries like India, whose highly skilled but less expensive labor is outsourced for analytical and pitch book work.

-> Make your choices smartly

If you change your jobs often, your loyalty towards your work will be at stake while applying for a great job. Hence, make your career choices smartly to avoid the side effects.

Related Articles

Here are some articles that will help you get more details about Investment Banking, so just go through the link.